unfiled tax returns 10 years

The IRS gives you 3 years from the due date of the return plus extensions to file your tax returns and 2 years from the date of payment whichever is later to claim your refund. Reduce The Stress And Minimize Your Tax Obligations With Tax Services From A Paro Expert.

Irs Notice Cp59 Form 1040 Tax Return Not Filed H R Block

That means the IRS has more time to seize your assets for.

. After May 17th you will lose the 2018 refund as the statute of limitations. Ad Owe back tax 10K-200K. Get free competing quotes from the best.

Ad Dont Face the IRS Alone. Owe IRS 10K-110K Back Taxes Check Eligibility. Yes if the IRS identifies that the taxpayer has an unfiled prior year return especially a return in which the IRS projects a balance owed they can freeze the refund and request the taxpayer.

In most cases the IRS requires you to go back and file. Get a Free Quote for Unpaid Tax Problems. Ad Quickly Prepare and File Your Prior Year Tax Return.

Before May 17th 2022 you will receive tax refunds for the years 2018 2019 2020 and 2021 if you are entitled to them. In general the Internal Revenue Service IRS has 10 years to collect unpaid tax debt. See if you Qualify for IRS Fresh Start Request Online.

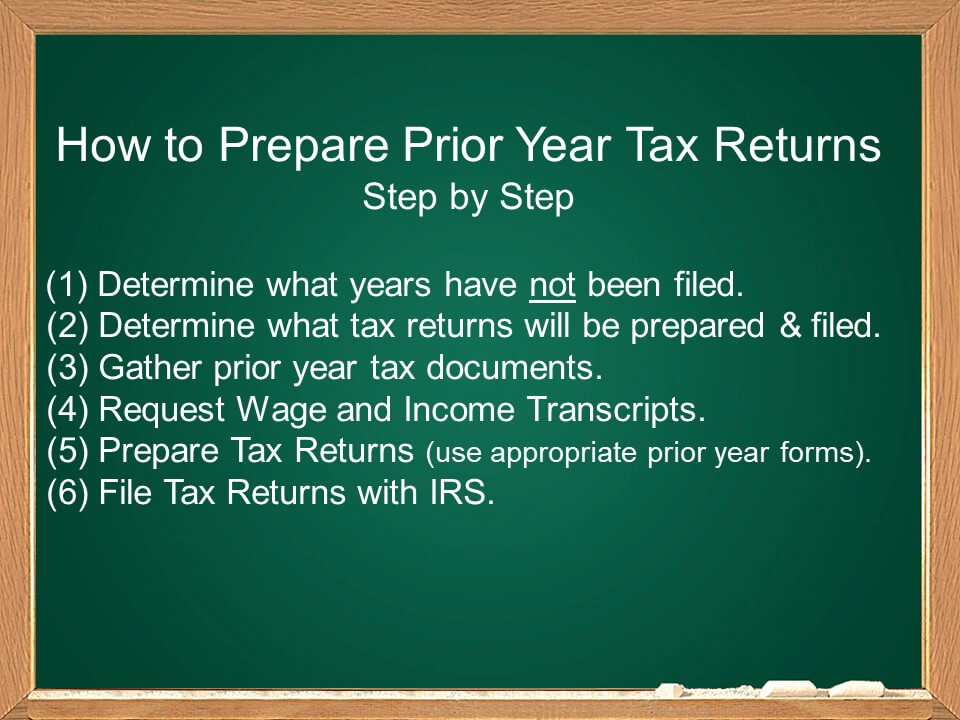

Start with a Simple and Easy Free Consultation. How to file back tax returns 1. After that the debt is wiped clean from its books and the IRS writes it off.

Theres no penalty for failure to file if youre due a refund. Help with Unfiled Taxes Unpaid Taxes Penalties Liens Levies Much More. However once the tax has been.

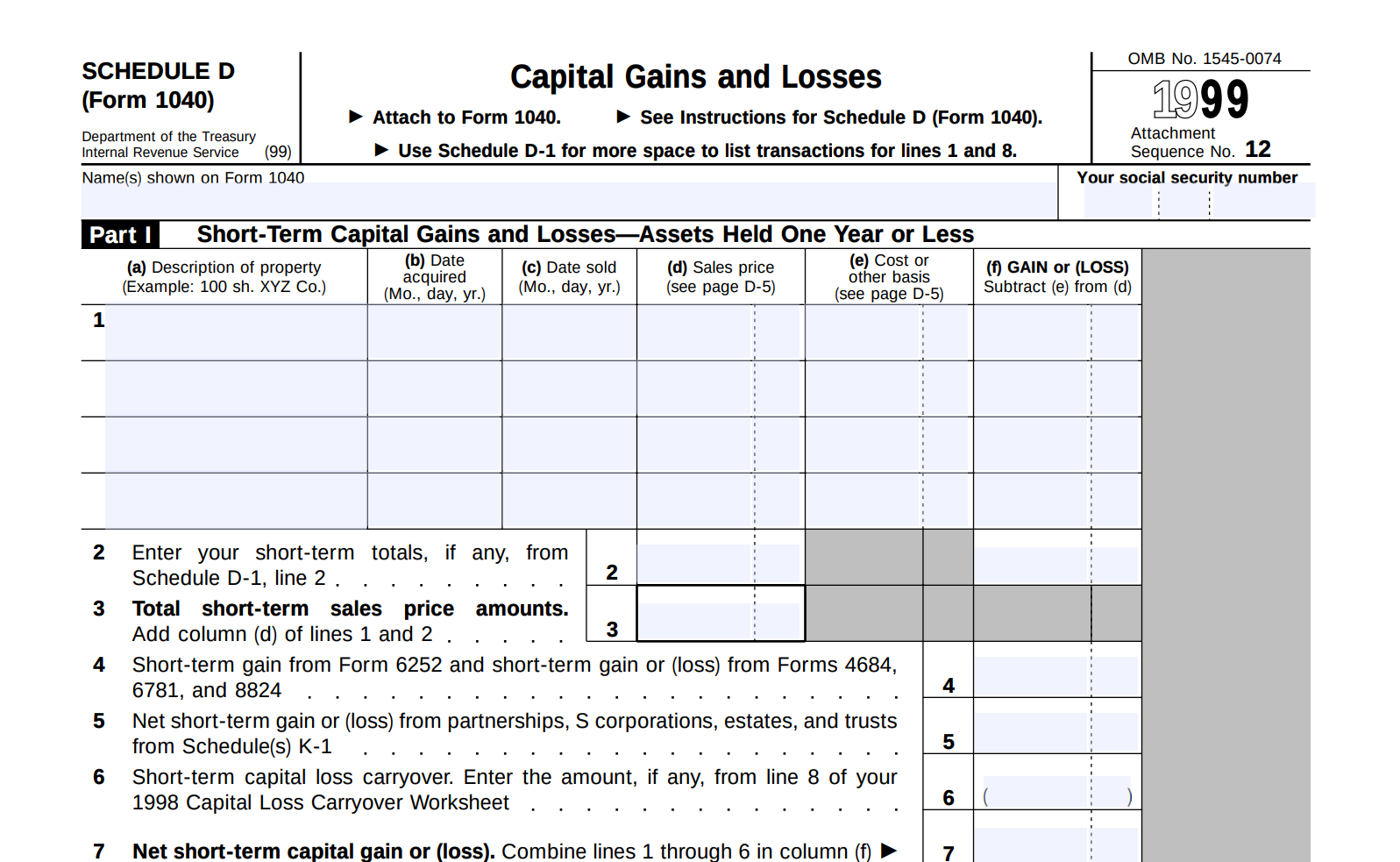

0 Federal 1799 State. We Help You Negotiate the Lowest IRS Payment Amount Allowed By Law. Every tax year has a filing requirement the minimum income the type of income your age your filing status whether you have to file or not.

Ad Get Back Taxes Help in 3 Steps. These transcripts will help you. Voluntary Disclosure if More than 10 years Outstanding Calgary Tax Lawyer Analysis.

Start by requesting your wage and income transcripts from the IRS. This means a legal battle which you shouldnt face alone. The penalty for not filing at all is x10 larger than the penalty for filing and then not paying.

The good news is that the IRS does not require you to go back 20 years or even 10 years on your unfiled tax returns. However you may still be on the hook 10 years later. Sort out your unpaid tax issues with an expert.

Ad Paros Tax Service Experts Will Ensure You File Accurately Optimally and On Time. If you dont file and owe taxes the IRS has no time limit on collecting taxes penalties and interest for each year you did not file. The statute of limitations for the IRS to collect taxeswhich is generally ten yearsalso doesnt begin until you file your return.

There is no statute of limitations on unfiled returns. Ad File Unfiled Returns With Max Deductions While Reducing Potential Penalties Interest. Your chances of lessening your penalties increase if you hire representation.

Ad Get Back Taxes Help in 3 Steps. If you need help with anything tax-related click. If you view the link at the top as of March 2022 vanguard is estimating returns of just 2-4 annualized for US equities and 15-25 for US aggregate bonds over the next decade.

Your 2017 tax returns are still unfiled the accountant reminded Biden two weeks later. For example in 2022 if. The CRA voluntary disclosure program VDP only applies to the last 10 years of tax issues such as.

The late fining penalty for a C-Corporation is 5 of the outstanding tax for up to five months. So always file even if you cant pay -- the penalty is larger that way. Start with a Simple and Easy Free Consultation.

In most cases the IRS requires the last six years tax returns to be filed as an. The minimum penalty is the smaller of the tax due or 135. Get a demo today.

For taxpayers who havent filed in previous years the IRS has current and prior year tax forms and instructions available on the IRSgov Forms and Publications page or by calling toll-free. Get all the information needed to file the past-due return. If you havent filed a return the IRS can go back to any time period and assess a tax against you.

Ad Our Licensed CPAs Attorneys IRS Enrolled Agents Are Here to Help You Achieve Tax Relief. Quickly Prepare and File Your Unfiled Taxes. Produce critical tax reporting requirements faster and more accurately.

Easy way to deal with unfiled tax returns If you think you could benefit from the help of a tax attorney schedule a consultation with one of our expert tax attorneys here or call. Ad Eliminate the burdens of gathering tax data with the help of insightsoftwares solutions. Here are 10 things you should know about getting current with your unfiled returns.

However you risk losing a refund altogether if you file a return or otherwise claim a refund after the statute of limitations. There is generally a 10-year time limit on collecting taxes penalties and interest for.

It S Been A Few Years Since I Filed A Tax Return Should I Start Filing Again H R Block

Unfiled Tax Return Penalties Can Be Very Expensive Make This Your First Step Hellmuth Johnson

How Far Back Can The Irs Collect Unfiled Taxes

What To Do If You Haven T Filed Taxes In 10 Years Debt Ca

Unfiled Tax Returns 101 I Peter E Alizio Cpa Esq

Unfiled Tax Returns Mendoza Company Inc

What Should You Do If You Haven T Filed Taxes In Years Bc Tax

Unfiled Irs Tax Returns Best Tax Relief Company Is

20 Or More Years Of Unfiled Tax Returns A Guide To Fixing It Tax Resolution Professionals A Nationwide Tax Law Firm 888 515 4829

Unfiled Tax Returns Archives Irs Mind

Unfiled Tax Returns Law Offices Of Daily Montfort Toups

What Should You Do If You Haven T Filed Taxes In Years Bc Tax

10 Or More Years Of Unfiled Tax Return A Guide On How To Resolve It Tax Resolution Professionals A Nationwide Tax Law Firm 888 515 4829

Unfiled Tax Returns Premier Tax Solutions

I Haven T Filed Taxes In 10 Years Or More Am I In Trouble

Unfiled Tax Returns 101 I Peter E Alizio Cpa Esq

Unfiled Tax Returns Notice Of Deficiency J David Tax Law

Unfiled Tax Returns The Law Offices Of Craig Zimmerman

10 Or More Years Of Unfiled Tax Return A Guide On How To Resolve It Tax Resolution Professionals A Nationwide Tax Law Firm 888 515 4829